TRENDS

Scotland’s hotel boom: figures show 5 year occupancy rise

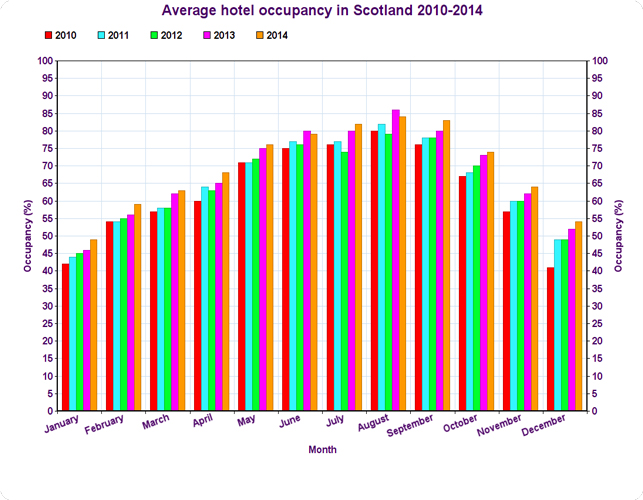

2014 was a bumper year for the Scottish hotel industry – it saw an average room occupancy of 70 per cent, an increase of seven per cent over five years.

Malcolm Roughead, chief executive of VisitScotland, told BigHospitality that he sees potential for further growth for the nation as long as it plays to its strengths.

“2014 was a Launchpad for tourism, inspiring global confidence in Scotland and creating an appetite for success. The industry is now using this momentum to grow and develop Scottish tourism for the future,” he said.

“After welcoming the world in 2014, this year has been an opportunity to take Scotland to the world, converting interest into the country into visitors for years to come. To do that we must use our strengths and assets, such as our breathtaking landscapes, warm hospitality and delicious foods to show that Scotland is the perfect place to visit, live and do business.”

Not only has the end of the recession had a positive effect on Scottish tourism, a number of high profile events have played their part.

“As the host nation of the Commonwealth Games, Ryder Cup and the Year of Homecoming, 2014 saw the world’s eyes fall on Scotland and the country shine on the international stage like never before. These major events of 2014 presented a unique opportunity to promote Scotland as a destination to hundreds of millions of people,” Roughead said.

Growth at a local level

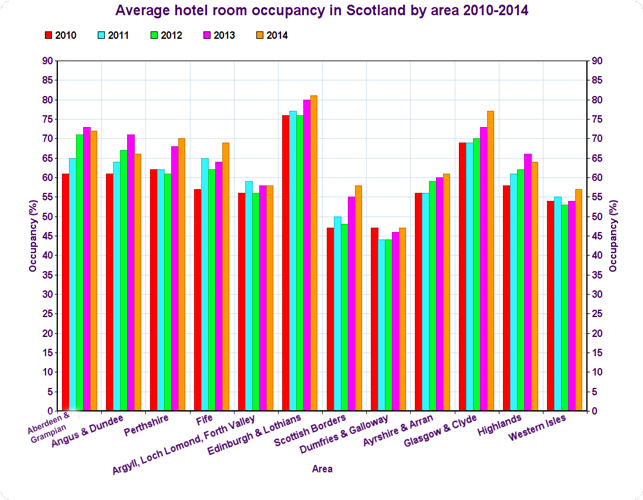

Edinburgh and Lothians was the best performing area between 2010 and 2014 with a peak of 81 per cent hotel room occupancy, while Aberdeen and Grampian and Fife saw the greatest improvement with a 12 per cent increase since 2010.

With this in mind, the outlook for Aberdeen is bleaker than 2014’s figures suggest. The decline in the Scottish oil industry has hit the Granite City hard with a report from accountants and business advisers BDO LLP showing that hotel occupancy dropped 17.5 per cent in May 2015 compared to the same month the previous year. The city had already seen a double-digit negative RevPAR growth of -10.1 per cent in February, something that Aberdeen City and Shire Hotels chairman said at the time was down to the “peaks and troughs” of the oil industry, but he expects the area to see growth soon.

Roughead said that VisitScotland is encouraging hotels in Aberdeen to adapt to the economic changes, although he insists that hoteliers have not been put off by the current slump.

“We are pleased to see that this has not deterred future investors and interest in the city from hotel developers remains high, highlighting a continued confidence in the city. The changes in the market also present an opportunity to grow Aberdeen’s reputation as a leading leisure destination, famed for its diverse culture and rich history.”

Glasgow has seen growth with the Commonwealth Games attracting over 700,000 unique visitors, helping bump the average hotel occupancy in the city up to 77 per cent, an eight per cent rise since 2010. So far 2015 has brought with it further boosts for hotels in Scotland’s second city with an occupancy rate of 92.7 per cent in June, a rise of over seven per cent since June 2014.

Coping with growth

While rapid growth can put a strain on hotels, Scottish hoteliers are preparing for a sustained period of growth by implementing new systems and recruiting experienced staff.

Stacey Fleming, head of sales and marketing at Crerar Hotel Group, told BigHospitality that that their reputation management tool is key to ensuring that standards are kept in this period.

“We have invested in technology upgrades and experienced people that understand channel distribution, as well as adding a reputation management tool which allows us to monitor guest reviews from multiple platforms in multiple languages ensuring we are keeping our core target markets satisfied,” she said.

“In months like July and August the opportunity is limited in occupancy growth as these months already command high levels and we will only see a slight growth in rate. We have taken this into consideration as there is a ceiling based on external factors such as the Pound versus the Euro, and what the domestic staycationer is prepared to pay to stay in the UK for a three or four star short break.”